Source: paymentsjournal.com

The world of payments is in a state of transition and rapid innovation. Global companies need to satisfy a customer base spread out across the world, with different areas using different payment methods and currencies.

Further complicating the landscape is that consumer demands are swiftly shifting. Consumers have more power and choice than ever before, and they have increasingly come to expect quicker and more seamless interactions and services.

This dynamic has caused customer experience (CX) to be a major focus of companies vying for customers’ business. A bad customer experience, even just one time, can cause consumers to go elsewhere. According to a study from Oracle, 89% of consumers began doing business with a competitor following a poor customer experience.

Since payments are central to the customer experience, the payments industry is especially focused on providing great CX. From real-time payments to biometric authentication, companies are offering tech-savvy consumers cutting-edge ways to manage, move, and spend their money.

To aid payments companies in adapting to the emerging trends, Worldpay from FIS published “Be a Champion of Change: How to Embrace Innovation to Meet Consumer Demand.” The white paper sketches out a blueprint for how to be successful in such a rapidly changing payments landscape.

It begins by identifying and elaborating upon four powerful technologies that can be used by payments companies preparing for the future: microservices, test-driven infrastructure, event-driven infrastructure, and hypermedia APIs.

Microservices

When it comes to video streaming, one of the most successful companies is Netflix. Every day, the company streams 250 million hours of video to 98 million customers in 190 countries. How does Netflix manage to do this? Microservice architecture.

As Worldpay from FIS’ white paper explains, “a microservice architecture is made up of multiple independently deployable, or loosely coupled, services.” In Netflix’s case, its platform is comprised of around 700 microservices.

Such an approach allows individual aspects of the system to be easily updated, added, or replaced without impacting the entire platform. This makes the system resilient to change, while also decreasing the time to take a new product to market.

In an industry like payments, where change is frequent and flexibility essential, microservice architecture allows companies to keep up with, and adapt to, shifting consumer trends.

Consider the proliferation of alternative payment methods. Consumers now have hundreds of ways of paying, varying by region, transaction type, and personal preference. The best way for a company to support the myriad of alternative payment options is through microservice architecture.

Worldpay from FIS notes that each payment method needs to be broken down “into its constituent domains, so that the mircoservices that make up its system can interact as needed.” This includes payment requests and connectivity, events, settlements, and so on.

Test-driven infrastructure (TDI)

TDI is a way of building infrastructure where the developer creates tests before writing the code. Since no code exists to pass the test, the test will invariably fail once run. This encourages the engineer “to write the simplest, most precise code that will pass the test,” explain the authors of the white paper.

The TDI approach results in robust infrastructure with more stable services and fewer instances of failure. And because TDI hinges on smaller iterations with small testable blocks of code, the systems are easier to maintain, the code is higher-quality, and it’s easier to get feedback if a failure occurs.

This is crucial in the payments industry, where the operating system needs to be strong and reliable. In e-commerce, for example, a slow website, or one that crashes, can cost the merchant a considerable amount of money.

When a customer wants to transact, it’s essential that they’re able to reliably do so in a timely manner.

Event-driven architecture (EDA)

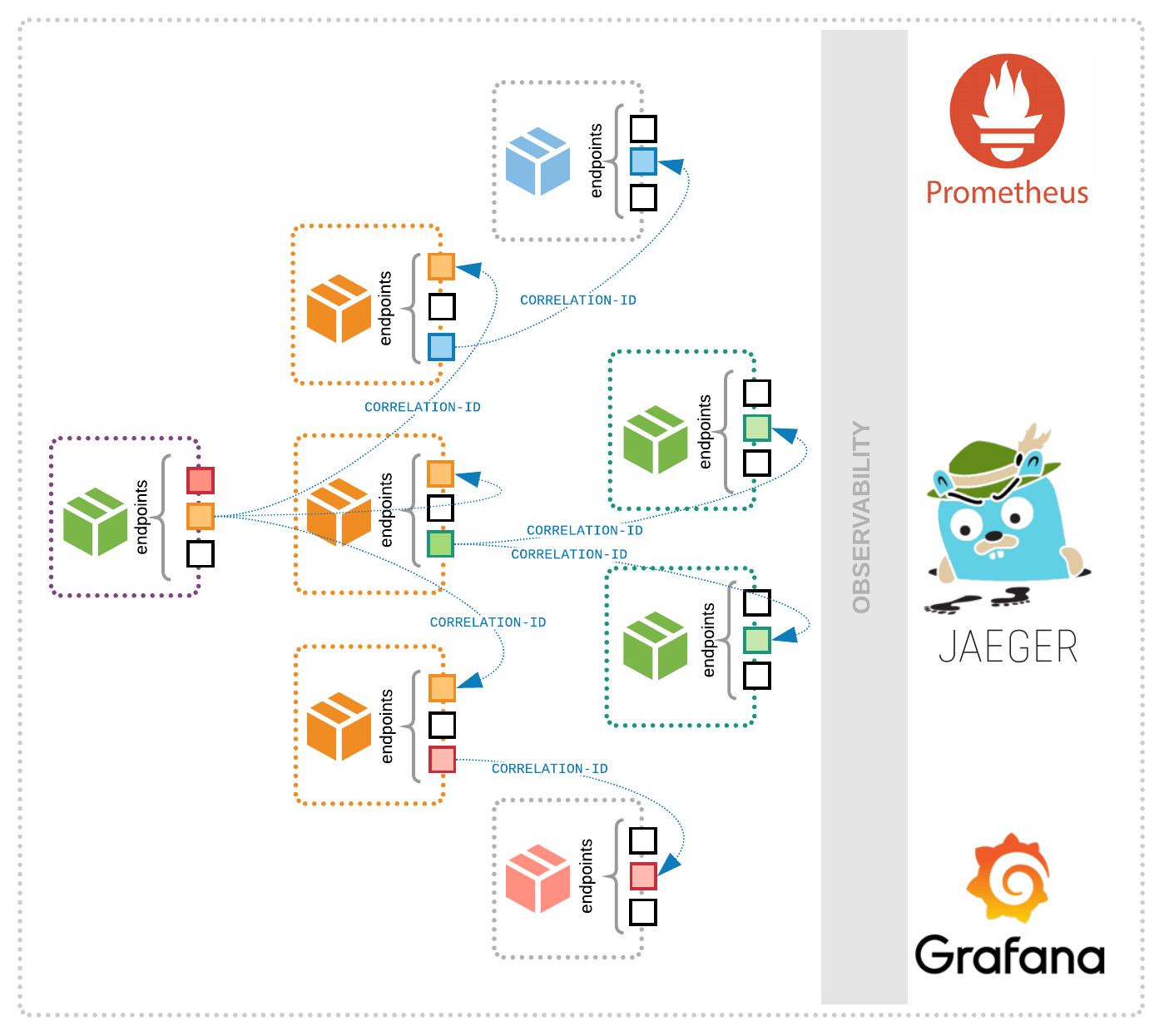

The third area Worldpay from FIS explores is event-driven architecture, which refers to a paradigm of software architecture rooted in an event producer broadcasting a message that one or more event consumers capture.

An event, as Worldpay from FIS describes, is “any meaningful change to a system.” In the context of e-commerce, this could mean the placement of an order because the fulfillment center would receive a notification about the sale prior to the order being processed.

It’s important to note that the event-driven approach to software is faster than the request-response alternative, as the former responds to information in near real-time. When it comes to the payments industry, this is essential, especially as faster and real-time payment options continue to catch on.

Consumers increasingly expect transactions to occur quicker and quicker, and companies have to invest in their infrastructure to meet this demand. EDA is better equipped to handle these types of transactions.

EDA also improves the strategic, operational, and functional agility of an organization.

Hypermedia APIs

The last technology explored by Worldpay from FIS in the white paper is hypermedia APIs. These are a sophisticated type of REST API (Representational State Transfer Application Programming Interface) that can make client integrations simpler, while improving resilience to change. An example of this type of API is Access Worldpay, a platform optimized for the payments industry.

Developers who interact with payment resources through hypermedia APIs, such as Access Worldpay, do not need to keep track of endpoints or URLs, possible states, or even the next step. Instead, “all API responses include the hypermedia links that provide pointers to the next possible state or step.”

The ability to simplify the integration process is important since the complexity of systems and applications has grown tremendously due to the rise of e-commerce, omnichannel apps, and changing consumer preferences.

For example, hypermedia APIs allow merchants to easily conduct identity and risk checks for e-commerce transactions.

Conclusion

With the payments landscape shifting and an emphasis on consumer experience becoming paramount, businesses need to leverage the newest technology and solutions in order to keep up. However, knowing what steps to take to get there can be challenging.

Microservices, test-driven infrastructure, event-driven architecture, and hypermedia APIs can help businesses offer the desired CX, but implementing them properly requires a plan and expertise.

As one of the premier companies in the payments landscape, Worldpay from FIS is well situated to provide this type of knowledge. The company’s white paper outlines the next steps a business should take in order to leverage these technologies.

The three major steps identified by Worldpay from FIS are:

- Adopt a DevOps approach in product engineering teams

- Empower teams and individuals with new skills

- Get all departments thinking CX-first

The white paper sketches out exactly what each of these steps entail and provides relevant statistics and graphics to illustrate key points.

If you’re interested in learning more, Worldpay from FIS’ “Be a Champion of Change: How to Embrace Innovation to Meet Consumer Demand” can be accessed here .