Source – seekingalpha.com

Summary

In the next 10 years, the artificial intelligence market will be increasing by an average of 50% each year.

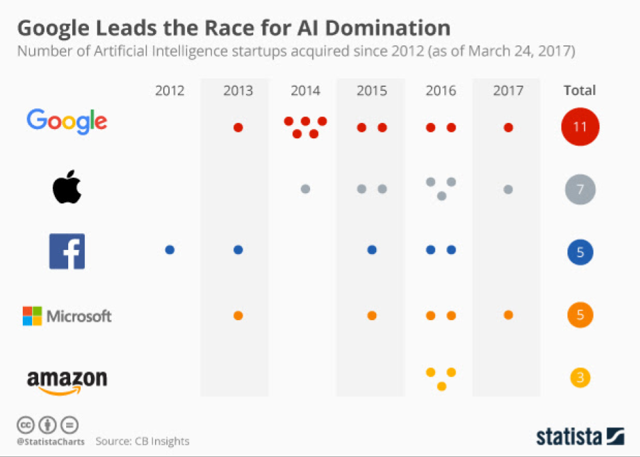

Over the past 6 years, Alphabet acquired more artificial intelligence startups than Facebook and Microsoft combined.

The first practical results of Alphabet in the field of artificial intelligence are qualitatively better than those of its key competitors.

An important shift from a mobile first world to an AI first world

Google CEO, Sundar Pichai

Investment Thesis

The active investments of Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) in the artificial intelligence market, the growth rate of which over the next decade will be four times higher than that of the digital advertising market, increase the long-term investment attractiveness of the company.

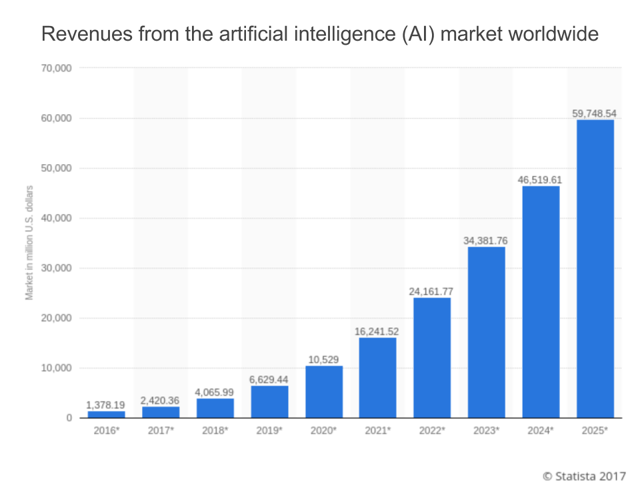

To begin, let’s take a look at the current growth forecasts for the global Artificial Intelligence (AI) market in the coming decade.

Here is information provided by Statista:

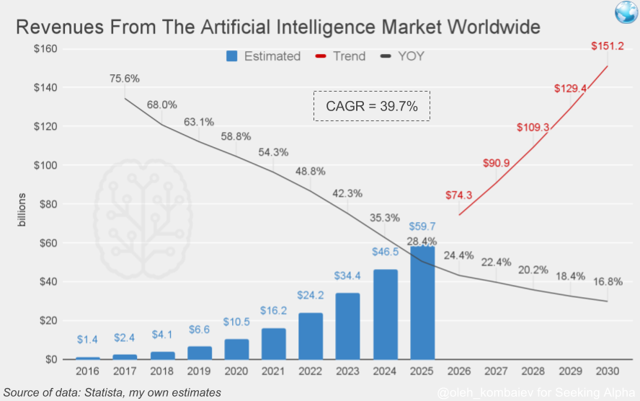

For a better clarity, I’ve slightly modified these data and projected the trend until the year 2030. Here is what I’ve got: over the next 15 years, this market will be growing at the CAGR of 40%, and in the next 10 years, it will be increasing by an average of 50% each year:

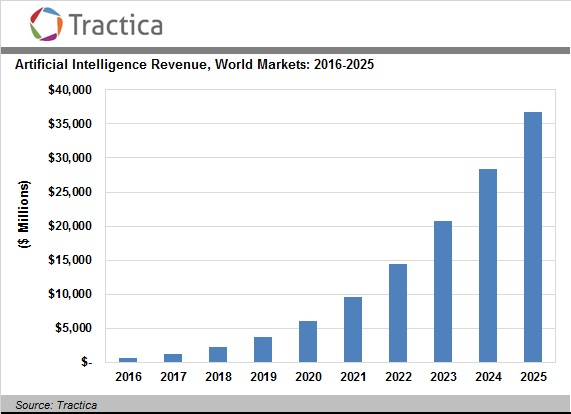

Tractica forecast (a market intelligence firm that focuses on human interaction with technology) is a bit more modest, but it still suggests that the annual worldwide AI revenue will grow from $643.7 million in 2016 to $36.8 billion by 2025, demonstrating a CAGR of 49.88%:

So, the growth in the next decade at an average annual rate of 50% – is really a lot?

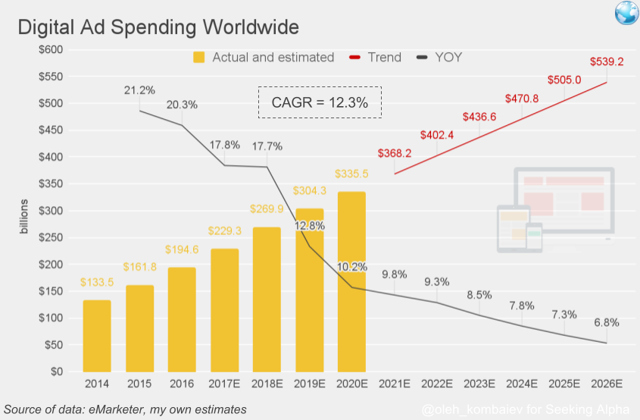

It depends on what to compare with, but given that I’m performing this analysis through the prism of perspectives for Alphabet, it probably makes sense to compare AI with digital advertising market, which is accountable for 87% of Google’s revenue.

As we can see, according to eMarketer’s data and assuming the trend will persist, in the coming decade this market will be growing at an average annual rate of 12.3%, i.e. four times slower than the AI market:

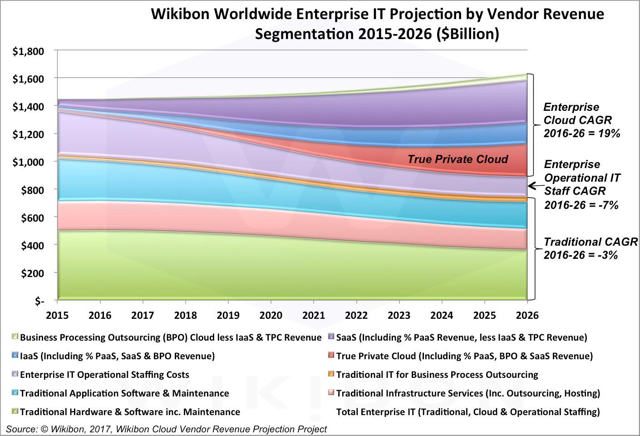

Also, Alphabet is one of the market leaders in cloud computing, therefore, I propose to compare the growth rate of this market with AI as well.

According to the Wikibon enterprise cloud spending will be growing at a CAGR of 19% between 2016 and 2026:

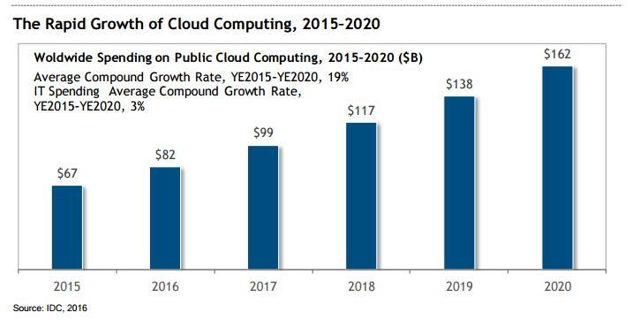

Approximately, the same forecast for the next five years was given by IDC:

So, in the horizon of the coming decade, the rates of growth of the AI market will be at least twice higher than those of the cloud computing market and four times higher than those of the digital advertising market. The most obvious conclusion from this: In order to ensure a double-digit annual growth rate in the next ten years, Alphabet needs to actively invest in the AI market. The good news for the owners of Alphabet shares is that the company is already actively doing it.

Starting with 2012, Alphabet acquired 11 startups specializing in AI, which exceeds the number of similar acquisitions by Microsoft (MSFT) and Facebook (FB) combined:

However, it should be remembered that the quantity does not always turn into quality. Nevertheless, if you judge about the success of Alphabet in the field of AI by the level of “artificial intelligence” of Google Voice Assistant, it becomes clear that the company is currently in a position of a leader.

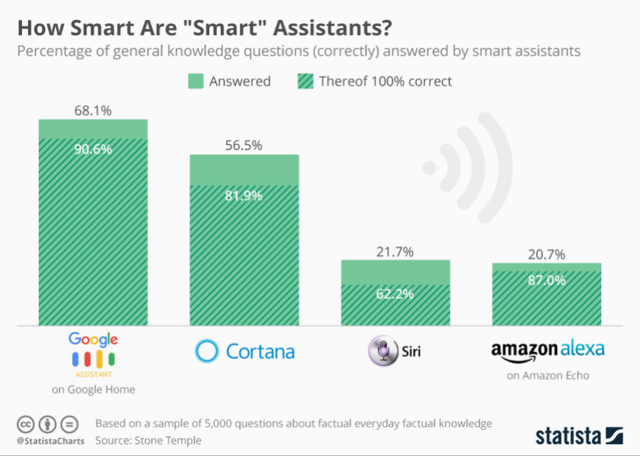

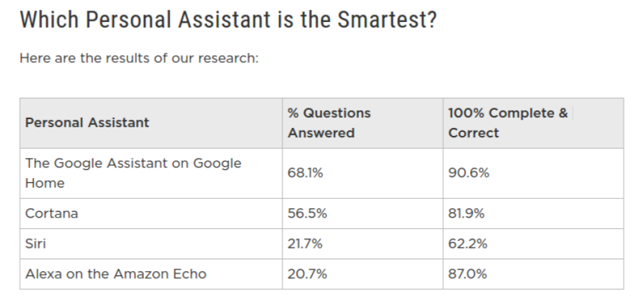

According to the March study conducted by Stone Temple, that compared the quality of the responses of intelligent assistants developed by Alphabet (Google Assistant), Microsoft (Cortana), Apple (AAPL) (Siri) and Amazon (AMZN) (Alexa), Google Assistant gave answers to the biggest number of questions, and also made the smallest number of mistakes:

Putting It All Together

It has been observed that not the fastest runner wins a long distance race, but the one who starts earlier. The AI market is an incredibly long “distance,” but, apparently, Alphabet has started this “race” first and is already a leader.

Moreover, Alphabet, being the most popular global search engine with an enormous amount of data, has all chances to remain on a leading position in the artificial intelligence market in the long term, and it will be the company’s growth driver for the next decade.

P.S. I have recently published my version of Alphabet’s valuation through the DCF analysis, and I came to the conclusion that, given the most conservative prediction parameters and the revenue growth at a CAGR of 12.5% in the next ten years, the fair price of the company’s shares will be at least 30% above the current level. Considering the figures provided in this article, I will probably have to review the DCF model, increasing the revenue growth forecasts. Of course, this will enhance the growth potential of the company’s share price.