Source – https://seekingalpha.com/

Summary

- The company has developed a security robot named ROAMEO and is valued at more than $700 million as of time of writing.

- However, the latest quarterly revenues were less than $0.12 million and Artificial Intelligence Technology Solutions is losing money.

- What’s worse, it has a negative working capital of $15.7 million as well as various convertible notes with interest rates of 10% and above.

- The main driver behind the company’s soaring share price seems to be high retail investor interest, which emerged a few weeks ago.

- I doubt the business is worth much considering the weak revenues and balance sheet.

Introduction

I’ve noticed that there’s significant interest from SA subscribers in my articles on OTC companies that are popular with retail investors, such as Tesoro Enterprises (OTCPK:TSNP), Viper Networks (OTCPK:VPER) and Healthier Choices Management Corp (OTCPK:HCMC).

In light of this, I thought it’s worth taking a look at Artificial Intelligence Technology Solutions (OTCPK:AITX), which is currently one of the most traded companies on the OTC market. It’s an artificial intelligence company with an interesting business focused on security robots.

However, Artificial Intelligence Technology Solutions is unprofitable and the business looks worthless, considering the working capital is negative. I think this one is a sell.

Overview of the business

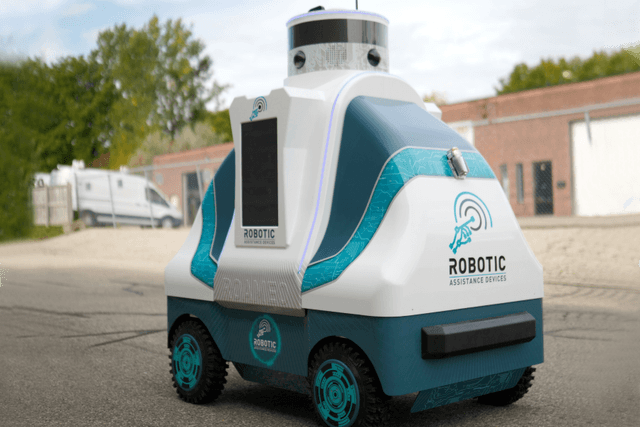

Artificial Intelligence Technology Solutions specializes in robotics and artificial intelligence-based hardware and software solutions. The company has several subsidiaries, including Robotic Assistance Devices, Robotic Assistance Devices Group, Robotic Assistance Devices Mobile, On the Move Experience and OMV Transports and its main products include security robots such as ROAMEO.

The company claims it has secured USD 16mn in conditional pre-orders on this product alone. The first ROAMEO unit was deployed in October 2020 and the client was an unnamed Fortune 500 firm.

In January, Robotic Assistance Devices announced that it entered the European Union market after receiving an order in Romania for two units.

Some of the other products in the portfolio of Artificial Intelligence Technology Solutions include a gate control system called AVA.

The products of Artificial Intelligence Technology Solutions certainly sound interesting but my concern is that they have limited market potential.

Looking at the company’s financials, revenues stood at just $0.12 million in the quarter ended November 2020. While the gross profit margin was impressive at almost 80%, the company booked a $0.9 million loss from operations due to pretty high general and administrative expenses for such a small business.

The balance sheet also looks bad as assets stand at just $0.7 million and working capital and book value are deeply in the red.

The company has a significant amount of convertible notes, which I think don’t have favorable interest rates and conversion rates.

Retail investor interest

One interesting thing that I noticed about Artificial Intelligence Technology Solutions is that its share price has recorded several short-term spikes over the past five years.

The latest one started around the end of December 2020 and shares have risen 598% in 2021 as of time of writing.

Just like the other three OTC companies I’ve covered in the recent past, Artificial Intelligence Technology Solutions has attracted significant interest from retail investors. On Twitter alone, there is a new tweet with the $AITX hashtag every few minutes at the moment. The company also seems to be popular on websites like Stockwits as well as reddit. Its own subreddit was created on December 30 and it has 3.7k members as of time of writing.

I think the company is doing an excellent job on the marketing front and you can find several recent interviews with its president Steven Reinharz on YouTube. Also, Reinharz’ profile on twitter features the #RADArmy tag, which has picked up traction on social media platforms over the past month.

Investor takeaway

Artificial Intelligence Technology Solutions has interesting products and I think the company is doing an excellent job of promoting its business and shares, especially on social media platforms.

However, the company is valued at over $700 million as of time of writing and I think this valuation is very hard to justify. Looking at the latest available financials, revenues are low and the Artificial Intelligence Technology Solutions is losing money. What worse, it has a negative working capital of $15.7 million and the book value is negative. I think this company isn’t worth much and it’s a sell.

The only scenario I see in which the bear case could be wrong is one in which ROAMEO becomes a revolutionary product in the security space. I view this as highly unlikely.