Source: ai4business.it

The economic inequality is increasing globally and is a growing concern because of its negative impact on growth opportunities, health and social welfare. Taxes are the primary tool that governments have to reduce inequality, however, find a tax policy that optimizes both equality as productivity is an unsolved problem.

Tax theory is based on simplifying assumptions that are difficult to prove, such as the effect of time taxes that people decide to work on. Furthermore, experimentation in the real world with taxes is almost impossible. It is in this context that the “AI-Economist” system developed by Salesforce makes use of artificial intelligence , which brings Reinforcement Learning (RL) for the first time in the design of fiscal policy to provide a completely simulation-based solution and on the data.

How does the AI-Economist study work?

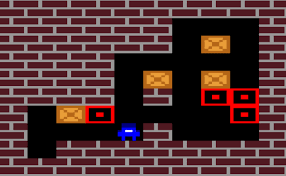

The simulation involves a two-dimensional world. There are two types of resources: wood and stone, but they are scarce and appear in the world at a limited rate. Workers move, collect and trade resources and earn income by building houses (using stone and wood). However, houses built block access to resources: workers cannot move through houses built by others. The simulation manages the development of any economy in the course of an episode, equivalent to the “career” of a worker. A fundamental characteristic is that workers have different skills. More skilled workers earn more from building houses, which creates greater utility. Building houses, however, costs effort, which reduces their usefulness. Workers pay income tax and the tax collected is then redistributed uniformly among the workers themselves. Taken together, these economic factors and other competitive drivers make it necessary for workers to be strategic to maximize their utility.

Our economic simulation produces interesting results when artificial intelligence agents (who are the workers in our economy) learn to maximize their utility. A salient feature is specialization: artificial intelligence agents with inferior skills become collectors and sellers and earn income by collecting and selling stone and wood. The agents with higher skills specialize as buyers and builders and purchase stone and wood to build houses faster. We are not the ones who impose these roles and behaviors. Rather, specialization emerges because differently skilled workers learn to balance their income and effort. The Reinforcement Learningis a powerful framework in which agents learn from experience, formed through trial and error . We use an RL without models, in which the agents have no knowledge of the previous world nor are there any modeling hypotheses.

The Reinforcement Learning approach

Our approach based on Reinforcement Learningit produces dynamic fiscal policies that produce a much better compromise between equality and productivity than the methods usually used. All tax policies make use of seven income brackets, following the framework of the United States’ federal income tax program, but tax rates change. The total tax is calculated by adding the tax for each bracket in which there is income, divided into ten tax periods of equal length. During each fiscal period the agents interact with the environment to earn income and, at the end of the period, the incomes are taxed according to the corresponding tax program and redistributed equally among the workers. The AI Economist fiscal policy allows the tax program vary between different periods.

Our experiments show that AI Economist achieves at least a 16% better result in the trade-off between equality / productivity compared to the best framework, which is that of Saez’s Formula. AI Economist improves equality by 47% compared to a completely free market, with an 11% drop in productivity.

Compared to the most used theories, AI Economist presents a more idiosyncratic structure: a mixture of progressive and regressive programs. In particular, there is a higher higher tax rate (income above 510), a lower tax rate for incomes between 160 and 510 and both higher and lower tax rates on incomes below 160. Taxes collected they are evenly distributed among agents. In fact, low-income agents receive a net subsidy, even if their tax rates are higher (before subsidies). In other words, with AI Economist, lower incomes have a lower tax burden.

We tried to understand if AI Economist was effective even with human participants. These experiments used a simpler set of rules to ensure greater usability, for example by removing the ability to trade. However, the same economic drivers and the same trade-offs have been applied . Participants were paid in real money for the utility they earned from building houses. Hence, participants were encouraged to build the number of houses that would maximize their usefulness. For experiments with human participants, we selected a “camel’s back” tax program from the AI-Driven policy set. In 125 games with over 100 participants in the United States, the camelback programit has achieved a compromise between equality and productivity that is significantly better than the free market and competitive with other mainstream theories . Compared to artificial intelligence agents, people were more prone to suboptimal contradictory behaviors, such as hindering other workers. This significantly increased the variance in productivity. Interestingly, the camelback program is qualitatively different from other tax theories. However, its relative performance is satisfactory in all experiments, both in matches with artificial intelligence agents, and in those with humans

Conclusions and possible future developments

The absence of substantial differences in the games played by humans and AI agents is surprising and encouraging. Therefore, these results suggest promising prospects for using AI Economist as a tool to find good fiscal policies in real economies.

Economic simulations based on artificial intelligence still have limitations . They do not yet model human behavioral factors, social interactions between people, and consider a relatively small economy. However, this type of simulation provides a transparent and objective view of the economic consequences of different tax policies. Furthermore, this particular approach can be used for any social goal in order to find a high performance tax policy. Future simulations could improve the loyalty of economic agents using real world data, while advances in large-scale RL and engineering could increase the scope of economic simulations.