Source: syncedreview.com

According to the World Social Report 2020 published by the UN Department of Economic and Social Affairs, income inequality has been widening since 1990 for more than 70 percent of the global population. The negative impacts on economic opportunity, health, and social welfare are seen to be accelerating divisions in economic and social development. Although taxes are a critical governmental tool for wealth redistribution, how to identify tax policies that promote equality without hurting productivity remains a daunting question for economists.

CRM company Salesforce recently open-sourced a new research project designed to improve both equality and productivity by using AI to create tax policies. In the paper The AI Economist: Improving Equality and Productivity with AI-Driven Tax Policies, researchers from Salesforce Research and Harvard University jointly propose their “AI Economist” as a simulation and data-driven approach for designing optimal tax policies. The AI Economist uses a two-level reinforcement learning (RL) framework (agents and tax policy) where a collection of AI agents simulate how humans might react to various taxes in a principled economic simulation. The framework learns from observational data alone how to optimize for any socioeconomic objective without using prior world knowledge or modelling assumptions.

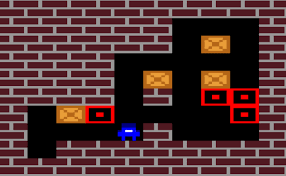

The proposed model rather resembles some video games: agents garner resources and income through building houses from stone and wood. Agents can trade resources for income, and need to move around the environment to find resources as others’ houses can sometimes block access. The agents have different skill levels, and the team notes that those with lower skills tend to work on collecting and selling stone and wood to earn coins, while the higher-skilled agents evolve to specialize in the purchasing of these materials and can build houses more quickly.

The simulation runs its economy for an episode analogous to a working career. The agents pay taxes while the AI Economist learns a tax schedule similar to US federal income taxes, computed through a deep neural network that factors public information such as agent income and resources. In addition to recommending how to set taxes, the AI Economist also advises on subsidies and wealth redistribution schemes that take income equality and productivity into account.

In experimental comparisons with Saez Framework, a prominent analytical formula for optimal taxation, the AI Economist improved the trade-off between equality and productivity by 16 percent. It also increased equality by 47 percent compared to free-market performance with a corresponding decrease in productivity of only 11 percent.

Although AI Economist offers a promising look at AI-based economic simulators for learning economic policies that could potentially transfer to the real world, Salesforce cautions that the current version is a very limited representation of the real world. The team hopes further model development could eventually empower prediction of real-world tax policies for improving income equality and productivity.

The researchers have open-sourced their economic simulation framework on GitHub. The paper The AI Economist: Improving Equality and Productivity with AI-Driven Tax Policies is on arXiv.